Why are car companies so bad at software and what can be done about it?

There is no doubt the auto industry faces its biggest ever disruption, greater than the Model T in 1908, the gas crisis of 1973 and auto bailouts of 2008.

The combination of software plus electrification places established giants like Ford, GM and VW at a disadvantage against newer, nimbler companies like Tesla or BYD. One hundred years of Internal Combustion Engine (ICE) evolution will be rapidly dispatched like the buggy whip to museums.

The cause of bad software - regulation and cost

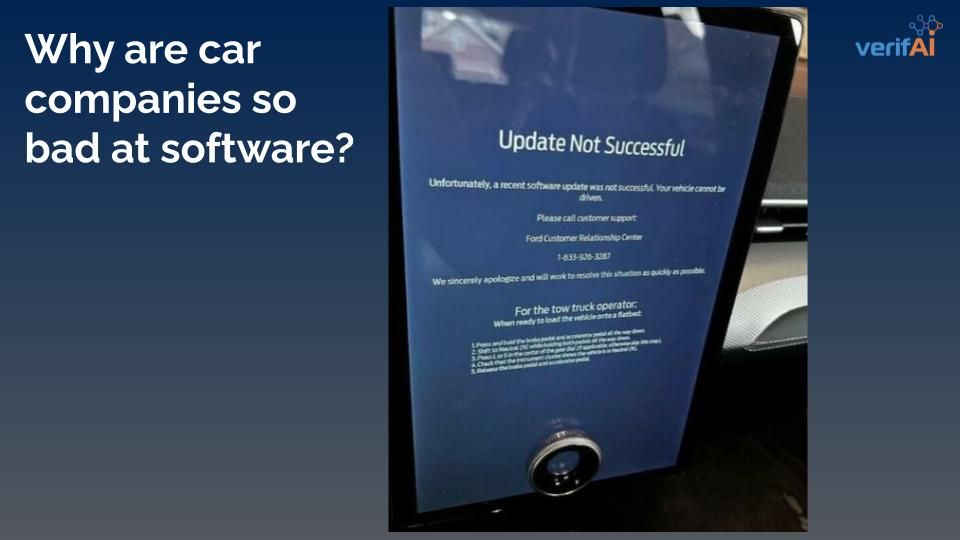

Cars are heavily regulated for good reason, our lives depend on them operating safely and reliably. Safety systems must be failsafe; ABS brakes, traction control, engine management - we cannot depend on software patches to fix safety problems once a vehicle is on the road, software must be ‘perfect’ right from the start. In addition, software must last the life of the vehicle, 10, 15 even 20 years.

Can you imagine using a PC from 20 years ago, with floppy disc drives and Windows 98?

Traditionally Auto OEMs relied on suppliers like Bosch or Magna to provide these vehicle safety systems. While outsourcing delivered the required safety system at reasonable cost (as suppliers serve many OEMs), it led to multiple independent and unconnected embedded systems inside vehicles.

OEMs consequently paid less attention to software, had little software culture (agile) and few senior executives with a software background. The safety imperative and regulatory oversight necessarily led to stifled software innovation.

The iPhone effect - customers now expect more

However, as cellular networks got faster and cars installed modems, it became apparent that a centralized software architecture was needed to take advantage of over-the-air updates and new applications.

Simply put, the entire software architecture philosophy of the vehicle had to be inverted from decentralized and outsourced to centralized and in-house. The car had to become an ‘iPhone on wheels’ with each OEM potentially creating their own operating system,

For the hundred year old OEMs, this culture and organization change to embrace software has not been easy. Recruiting, training and developing an entirely new skill set for a huge organization takes time.

In addition to this architecture change, auto OEMs faced a charging trojan horse in the form of the iPhone itself. People using iPhones and Android phones love the user experience and wanted to connect to vehicle display screens for navigation and entertainment.

Given the ubiquitous nature of smartphones, auto OEMs were forced to surrender to the customer and enable Apple CarPlay and Android Auto - effectively ‘hollowing out’ their own, often inferior navigation and entertainment offerings, and reducing the opportunity for differentiation against competitors. This led to internal confusion over strategy along with demotivated internal development teams.

The current state - software is more important than ever

The recent software trajectory of cars has been staggering. New cars now have multiple input and output devices; screens, sensors (cameras, tire pressure, airbag, seat belt), diagnostic capabilities, safety systems, navigation and entertainment.

It is estimated that luxury vehicles have ~100m lines of code and may soon reach ~300m lines as fully autonomous driving is realized.

The automotive software market is estimated to be worth a quarter of a trillion dollars annually and software is becoming integral for revenue to enable subscription services for performance, comfort (e.g., heated seats), safety (e.g., OnStar) and entertainment.

Lastly, given this complexity, software recalls have ballooned costing OEMs over $1.5bn in 2022.

The result - bad software / muddled strategy

Combining this dramatic market trajectory with the internal lack of skills, software culture shock, pivot to a centralized in-house OS, and hollowing out by internet companies, its no surprise that OEM software initiatives are falling short.

VW’s software group Cariad had an executive shakeup and laid off 2,000 people in November due to poor results.

Additionally, the approach towards CarPlay / Android Auto appears muddled with OEMs flip flopping their strategies from embracing to banning as the internet companies become more deeply embedded in the vehicle seeking control of the main telematic screen (e.g., speed, RPM) and further diminishing OEMs own cockpit branding.

AI creates additional risks in future

Despite the recent avalanche of publicity surrounding AI and LLMs like Chat GPT, there is concern among software developers regarding unforeseen consequences arising through the use of these sophisticated tools to write new code.

Firstly the sheer volume of code is anticipated to increase by up to 20x through the enormous productivity benefits the tools provide developers. Compounding this first outcome is a secondary fear that code developed using these tools may create errors which are unique to LLMs;

- Hallucinations

- Poor Logical Reasoning

- Poor Accuracy - LLMs are Token Simulators

- Inability to produce related blocks of code

What can be done about it - Faster Software Verification

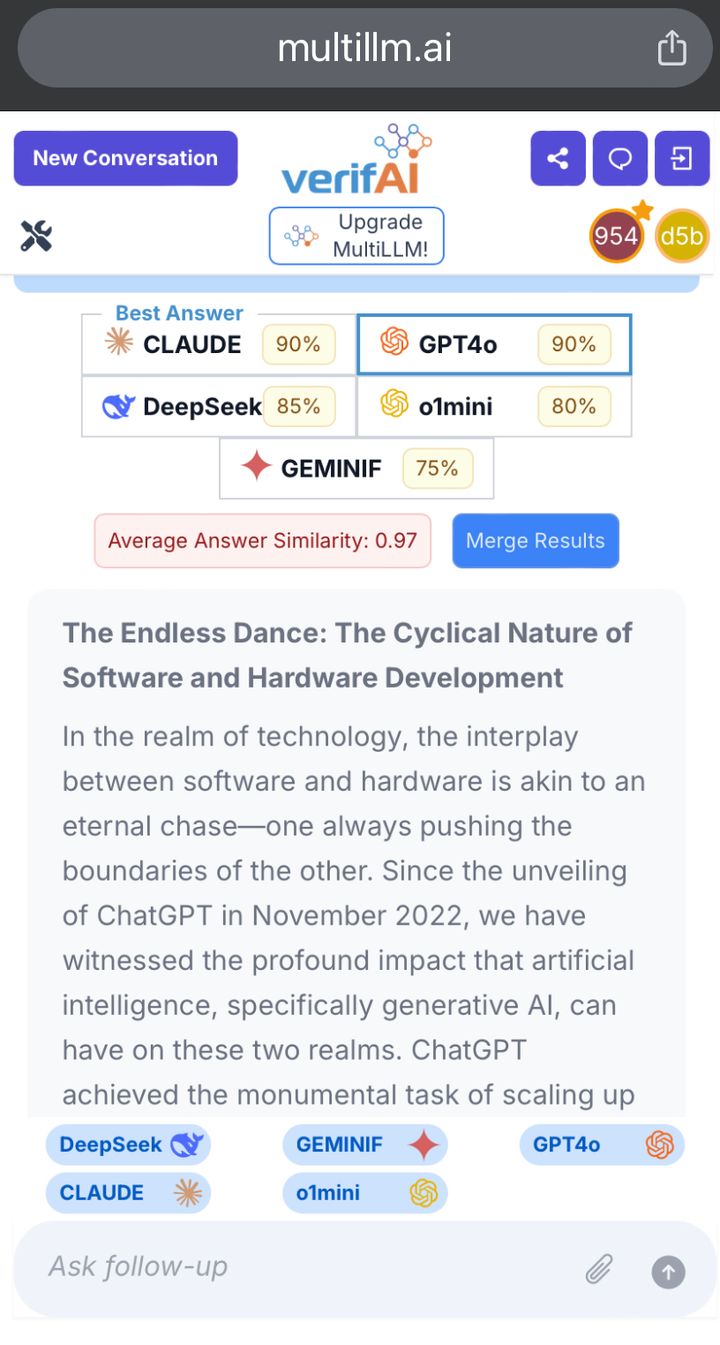

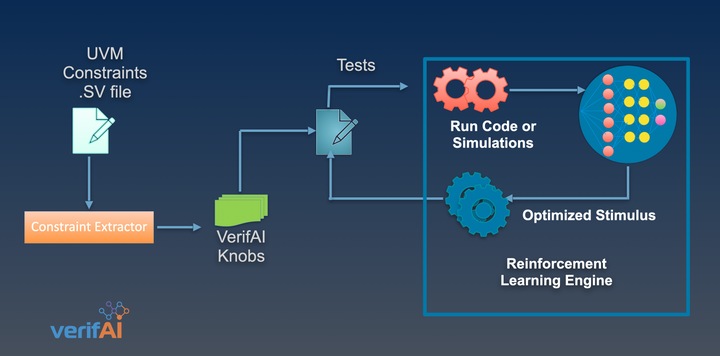

Given the magnitude and complexity of the automotive industry software issues there is no single magic solution. However VerifAI.ai, a silicon valley startup believes that by harnessing AI and Reinforcement Learning, they can dramatically speed up software verification by up to 100x.

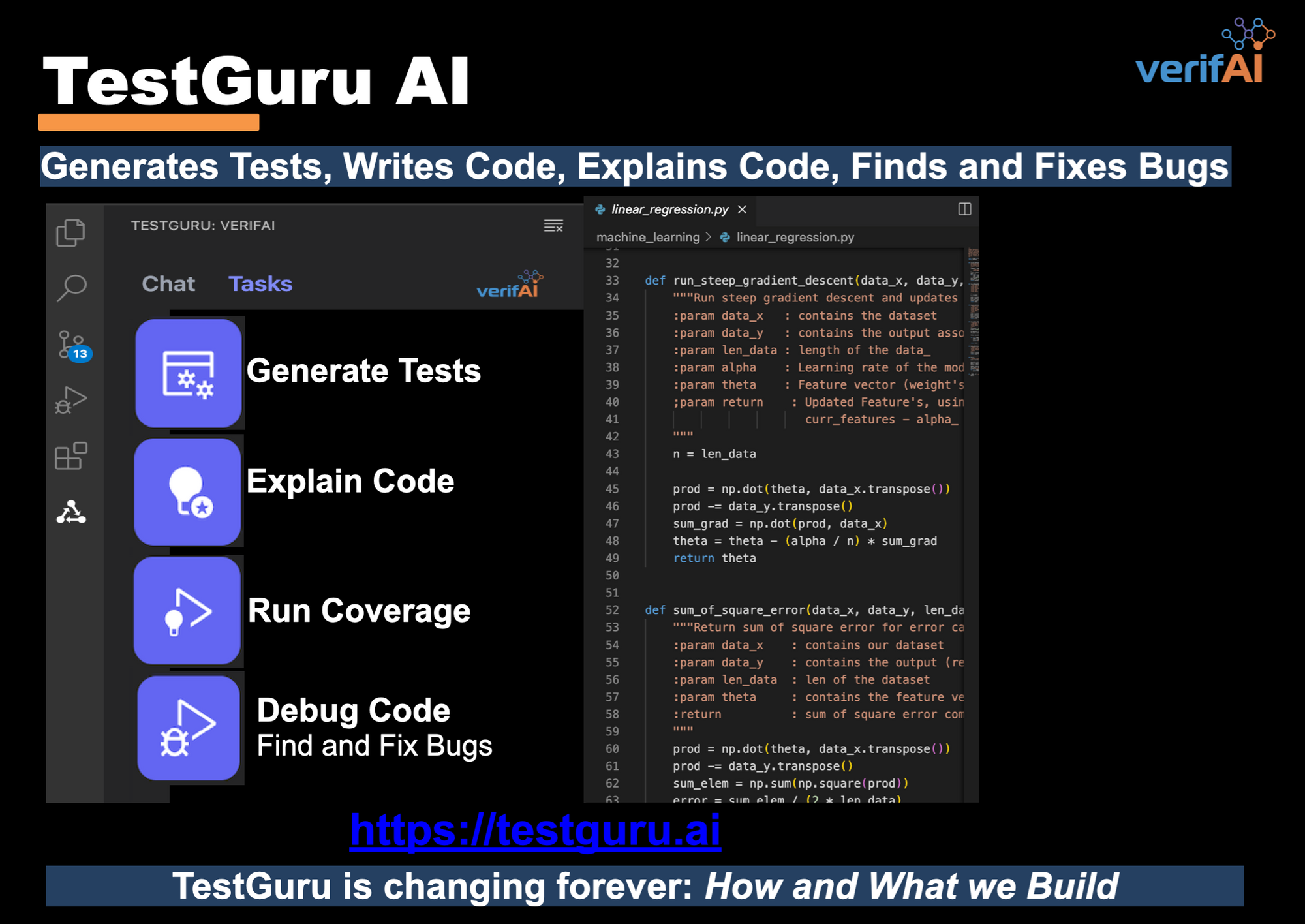

VerifAI's product, Test Guru enables non-specialists to generate tests, write code, explains code, finds & fix bugs

To learn more, please sign up for our trial....https://www.testguru.ai